Executive Summary

Local governments, utilities, and community leaders face growing obligations to safeguard their constituents against power outages that can disrupt critical services, threaten public health, and paralyze economic activity. Microgrids, which are localized electrical grids that can disconnect from the traditional grid and operate autonomously using local energy sources, represent a critical defensive tool against widespread power disruptions, yet remain challenging to implement due to regulatory complexity, high upfront costs, and technical barriers.

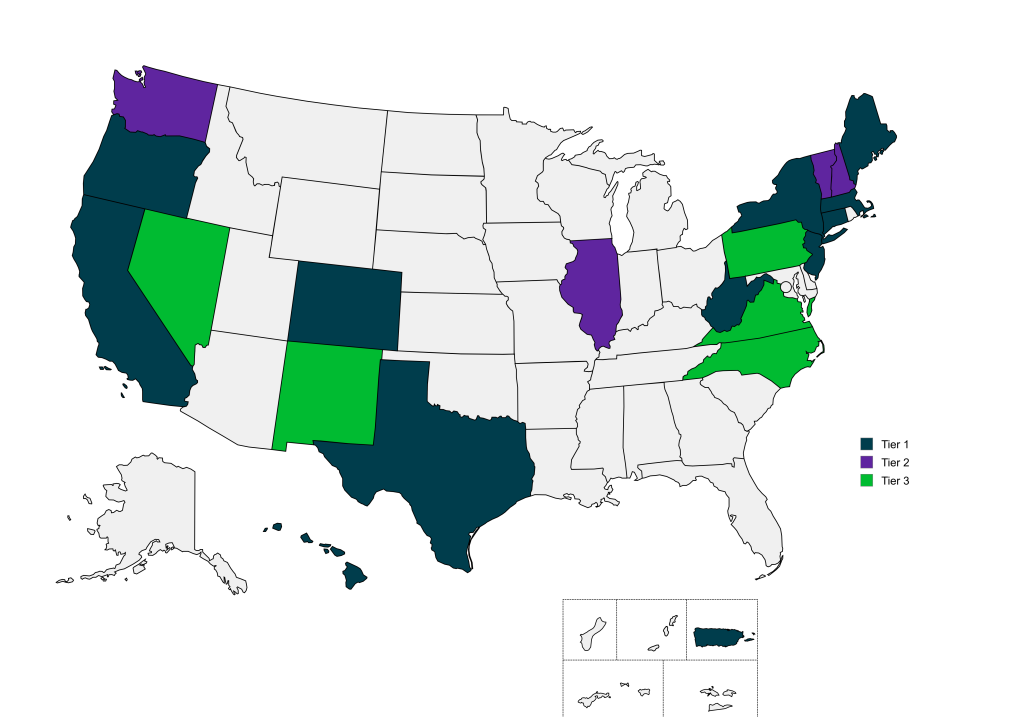

This report presents a comprehensive analysis of the microgrid market across the United States, examining how different regulatory frameworks either facilitate or hinder microgrid development, the incentive programs available to offset implementation costs, emerging commercial opportunities, and proven strategies for successful market entry. The research encompasses 21 states and territories, revealing significant variations in how jurisdictions approach microgrid policy development and the resulting impact on deployment success rates. States can be categorized into three tiers based on their microgrid policy activity:

Tier 1 (Comprehensive Microgrid-Specific Regulation): California, Hawaii, New Jersey, New York, Connecticut, Massachusetts, Texas, Puerto Rico, Maine, West Virginia, Colorado, Oregon

Tier 2 (Significant Policy Development): Illinois, Washington, New Hampshire, Vermont

Tier 3 (Limited Microgrid-Specific Policy): Pennsylvania, Nevada, New Mexico, Virginia, North Carolina

Figure 1: Tiers of US States based on microgrid policy activity

Key market drivers include:

- Grid resilience needs in response to extreme weather events

- Clean energy and decarbonization goals

- Critical infrastructure protection

- Energy independence for remote and island communities

Successful market entry requires a sophisticated understanding of the financial landscape, regulatory environment, and stakeholder priorities that vary dramatically across jurisdictions. The most effective strategies focus on leveraging federal, state, and local funding mechanisms that can offset the substantial upfront investment required for microgrid infrastructure. Strategic partnerships prove essential because microgrid projects typically require expertise spanning electrical engineering, regulatory compliance, project finance, and ongoing operations and maintenance. The value proposition must extend beyond simple cost savings to emphasize the resilience benefits that protect communities during emergencies, enhance energy security, and support economic development goals that local leaders care deeply about achieving.

Introduction

Microgrids represent a transformative approach to energy generation, distribution, and management, offering enhanced resilience, integration of renewable resources, and local control over energy systems. As climate-related disruptions increase and the clean energy transition accelerates, microgrids have gained significant traction across the United States.

This report analyzes the microgrid market landscape across 21 states and territories, providing insights into regulatory frameworks, incentive programs, commercial opportunities, and strategic approaches for market entry. The analysis is intended to support outreach efforts targeting key stakeholders including solar developers, engineering firms, architecture firms, contractors, city officials, emergency management offices, and small electric utilities.

Click here to download a shareable PDF version of this analysis.

Regulatory Frameworks & Policies

Leading States (Tier 1)

California

California has established a comprehensive regulatory framework for microgrids through SB 1339 (2018), which directed the California Public Utilities Commission (CPUC) to develop microgrid-specific policies. The California Public Utilities Commission (CPUC) has implemented this legislation through several key developments:

- Formal microgrid proceeding initiated in September 2019

- Microgrid Incentive Program (MIP) implementation rules approved in April 2023

- Statewide competitive grant program with $200 million allocation

The MIP funding is distributed among major utilities with specific allocations: $79.2 million for Pacific Gas & Electric (PG&E), $83.3 million for Southern California Edison (SCE), and $17.5 million for San Diego Gas & Electric (SDG&E). Projects under this program must meet technical requirements including 24-hour islanding capability and compliance with emissions standards.

In addition to MIP, California offers the Community Microgrid Enablement Program (CMEP), which provides financial and technical support for community microgrid development and is available to eligible projects that complete the necessary steps.

Hawaii

Hawaii has pioneered microgrid policies through the Microgrid Services Tariff (MST) created by House Bill 2110 (Act 200) in 2018 and fully implemented by the Hawaii Public Utilities Commission (PUC) in 2021. The framework defines three categories of microgrids:

- Customer microgrids (behind the meter)

- Third-party microgrids (serving multiple customers)

- Utility microgrids (owned by utilities)

Hawaii has set ambitious clean energy goals through its Renewable Portfolio Standard (RPS), which mandates 100% renewable energy by 2045, and identifies microgrids as essential tools for grid resilience and renewable energy integration. The state has implemented streamlined interconnection procedures specifically for microgrids, reducing bureaucratic hurdles and expediting approval processes.

New Jersey

New Jersey established its regulatory framework for microgrids in response to Superstorm Sandy, creating the Town Center Distributed Energy Resources (TCDER) Microgrid Program. The state categorizes microgrids into three levels:

- Level 1 (Single Customer Microgrid): Single-owner systems with backup generators or off-grid inverters

- Level 2 (Campus Setting/Partial Feeder Microgrid): Multiple DER systems connecting multiple buildings controlled by one meter

- Level 3 (Multiple Customers/Advanced Microgrid): Systems serving several buildings not on the same meter or site

The TCDER program was implemented in phases, with Phase I providing feasibility study funding and Phase II supporting detailed design. Assembly Bill A5040 aims to establish a framework enabling TCDER program participants to overcome legal and statutory impediments to project development.

New York

New York’s microgrid development is embedded within larger energy initiatives, particularly the Reforming the Energy Vision (REV) and the Climate Leadership and Community Protection Act (CLCPA). The state’s approach to microgrids focuses on enhancing grid resilience while advancing clean energy goals.

Key regulatory aspects include:

- Utility regulation status for microgrids, with precedent allowing microgrids to avoid utility-level regulation under specific conditions

- Tariff structures being reformed to accommodate microgrids more effectively

- Value of Distributed Energy Resources (VDER) mechanism serving as an alternative payment method

The NY Prize Competition, launched in 2015 with an initial funding of $40 million, follows a three-stage process for microgrid development:

- Stage 1: Feasibility Studies (up to $100,000 in funding)

- Stage 2: Detailed Engineering Design & Business Planning (up to $1 million per project)

- Stage 3: Project Build-out (up to $7 million per project)

Connecticut

Connecticut established itself as a pioneer in microgrid policy through Public Act 12-148, Section 7, which created the first state-level Microgrid Program in response to widespread power outages in 2011. The program was expanded through Public Act 13-298, which authorized additional funding of $30 million.

Connecticut law defines microgrids as “a group of interconnected loads and distributed energy resources within clearly defined electrical boundaries that acts as a single controllable entity with respect to the grid and that connects and disconnects from such grid to enable it to operate in both grid-connected or island mode.”

The state identifies “critical facilities” eligible for microgrid development, including hospitals, police stations, fire stations, water treatment plants, sewage treatment plants, public shelters, correctional facilities, commercial areas of municipalities, and municipal centers.

Massachusetts

Massachusetts ranks as a Tier 1 state for microgrid policy activity. The regulatory framework includes:

- Grid Modernization Proceedings by the Massachusetts Department of Public Utilities (DPU) addressing microgrid integration

- Utility franchise rights that give utilities the right of first refusal regarding ownership and operation of infrastructure within “public ways”

- Clean energy policies that microgrids can help satisfy through increasing deployment of low and no-carbon energy generation

The Massachusetts Clean Energy Center (MassCEC) launched a Community Microgrids program that supported the design of community microgrids throughout the state, awarding $1.05 million in funding for 13 feasibility studies in February 2018.

Texas

Texas has made significant strides in supporting microgrid development through recent legislation, particularly Senate Bill 2627 (2023), which allocates $1.8 billion for microgrid development and provides grants capped at $500 per kilowatt of capacity for facilities up to 2.5 MW. This bill was part of a broader $10 billion Texas Energy Fund approved by voters in November 2023.

The bill introduced the concept of a “Texas backup power package,” defined as “a stand-alone, behind-the-meter, multiday backup power source that can be used for islanding.” Key requirements include the ability to operate continuously for at least 48 hours without refueling or connecting to the grid.

Texas’s unique electric grid arrangement, operated by the Electric Reliability Council of Texas (ERCOT), gives the state more flexibility in designing energy policies. ERCOT has specific market mechanisms benefiting microgrid operators, including the Four Coincident Peak (4CP) program, which allows customers to reduce their electric usage during peak months to receive credits.

Puerto Rico

Puerto Rico has established a comprehensive legal framework for microgrids through the Puerto Rico Energy Public Policy Act (Act 17-2019) and the 2018 Regulation on Microgrid Development by the Puerto Rico Energy Commission (now Energy Bureau). The regulation defines three main types of microgrids:

- Personal Microgrids: Owned by no more than two persons and generally exempt from most regulatory requirements

- Cooperative Microgrids: Constituted by members who share ownership interest and receive services

- Third-Party Microgrids: Owned or operated by any person for selling Energy Services or Grid Services to customers

The regulatory framework includes specific interconnection requirements, with PREPA or future concessionaires required to allow interconnection of electric service companies, distributed generation systems, and microgrids when technically feasible. Applications must be evaluated within 90 days, with non-compliance subject to fines of $1,000 per day.

Maine

Maine has established a comprehensive regulatory framework specifically for microgrids through Title 35-A, §3351, which provides clear pathways for development while protecting utilities and consumers. The law explicitly states that entities operating approved microgrids do not become public utilities, exempting them from associated regulatory burdens.

The Public Utilities Commission (PUC) must approve microgrid petitions that meet specific requirements, including:

- Location in service territory of a utility with more than 50,000 customers

- Distributed energy resources meeting Maine’s renewable portfolio requirements

- Developer demonstrating financial and technical capacity

- Contractual relationship between operator and consumers

- No negative effect on grid reliability and security

The original law limited microgrids to 10 MW, but this cap was later raised to 25 MW to accommodate larger projects.

West Virginia

West Virginia has recently established a comprehensive microgrid framework through the Power Generation and Consumption Act (HB 2014/SB818). This legislation:

- Establishes a Certified Microgrid Program and High Impact Data Center Program

- Allows the Department of Commerce to identify and certify microgrid districts with significant economic potential

- Modifies utility regulations and tax structures to support microgrid implementation

- Enables companies to develop independent energy grids using natural resources

- Permits up to 10% of electricity generated by microgrids but not used by the facilities to be sold on the wholesale market

This legislation represents a significant advancement in microgrid policy for the state, placing it among the leaders in comprehensive microgrid regulation.

Colorado

Colorado established a strong legislative foundation for microgrids through two key bills passed in 2022:

- House Bill 22-1013: Created the Microgrids for Community Resilience (MCR) grant program with initial funding of $3.5 million, specifically targeting cooperative electric associations and municipally owned utilities serving rural communities

- House Bill 22-1249: Directed the Colorado Energy Office (CEO) and Department of Local Affairs (DOLA) to develop a Grid Resilience and Reliability Roadmap

The MCR grant program has funded 25 planning and construction projects totaling approximately $17.7 million. Eligible applicants include utilities, local governments, and public/non-profit community anchor institutions, with projects required to meet specific technical specifications including 24-hour islanding capability.

Oregon

Oregon has several key policies and legislative initiatives that support microgrid development:

- Recently, two companion microgrid laws were passed. HB 2065 refines the interconnection design and review process, enabling third-party engineering firms to do more of the network design. HB 2066 defines new terms such as microgrid zone and operator, while also establishing the right of communities to advance microgrids that collaboratively utilize the utilities systems.

- House Bill 2021 (2021): Established the Community Renewable Energy Project Grant Program, which explicitly includes microgrids as eligible technologies

- House Bill 3378 (2023): Provides $2 million for county energy resilience planning grants, which can include microgrids

- Oregon Administrative Rules: Define microgrids as eligible technologies under various grant programs and incentive structures

For community renewable energy projects that qualify as “community energy resilience projects,” grants may cover up to 100% of project costs, not to exceed $1 million. Energy Trust of Oregon is developing new pathways for communities pursuing FEMA grants for resilient renewable energy microgrids.

Advancing States (Tier 2)

Illinois

Illinois has established itself as a moderate leader in microgrid policy development, with several key policies shaping the landscape:

- Illinois Commerce Commission (ICC) Authority: The ICC provides a regulatory pathway for microgrid projects without requiring new legislation for each project

- Climate and Equitable Jobs Act (CEJA): This law contains numerous utility regulatory requirements that reshape grid planning and operation

- Multi-Year Integrated Grid Plans: Required from large utilities to support decarbonization and facilitate distributed energy resource deployment

- Performance-Based Ratemaking: CEJA requires approval of performance-based metrics and incentives supporting core goals

The ComEd Bronzeville Community Microgrid in Chicago serves as the state’s most significant microgrid development, serving more than 1,000 customers including the Chicago Public Safety Headquarters.

Washington

Washington has demonstrated strong support for microgrid development through the Clean Energy Fund (CEF) and Grid Modernization Program, which has provided funding specifically for microgrid projects that:

- Advance clean, renewable energy technologies

- Support renewable integration

- Increase utility customer choice

- Deploy distributed energy resources and sustainable microgrids

The state’s Clean Energy Transformation Act (CETA) commits Washington to an electricity supply free of greenhouse gas emissions by 2045 and provides safeguards to maintain affordable rates and reliable service.

New Hampshire

New Hampshire established a regulatory framework for microgrids through the Limited Electrical Energy Producers Act (LEEPA) and the state’s Public Utilities Commission (NHPUC) regulations. The state has been moving toward a more supportive regulatory environment through several initiatives:

- The State Energy Strategy emphasizes grid modernization and resilience

- NHPUC docket IR 15-296 explored grid modernization including microgrid considerations

- HB 1338 (2020) directed the NHPUC to establish rules for municipal host microgrids

Several policies support microgrid development:

- Community Power Aggregation: Enables municipalities and counties to procure electricity, creating opportunities for local microgrids

- Net Metering: Offered for systems up to 1 MW, which can be incorporated into microgrid designs

- Group Net Metering: Allows multiple customers to share the benefits of a single distributed generation system

- Municipal Host Customer Limited Electrical Energy Producer: Allows municipalities to serve as hosts for microgrids

Vermont

Vermont has been proactive in developing a regulatory framework that supports microgrid development, with a strong emphasis on renewable energy integration and resilience. Key elements include:

- Rule 5.500: Outlines interconnection procedures for distributed generation, including microgrids

- Renewable Energy Standard (RES): Requires utilities to procure increasing amounts of electricity from renewable sources

- Act 56: Established Vermont’s Renewable Energy Standard, mandating that utilities source 75% of their electricity from renewable sources by 2032

The Clean Energy Development Fund (CEDF) provides grants and loans for renewable energy projects, including those that incorporate microgrids. Vermont’s Standard Offer Program guarantees long-term contracts for small-scale renewable energy producers, providing financial stability for microgrid projects.

Tier 3: Limited Microgrid-Specific Policy

Pennsylvania

Pennsylvania currently lacks explicit laws defining microgrids, creating regulatory uncertainty. As William Patterer from Exelon noted, “These assets are neither purely distribution nor purely generation and our public utility laws do not address these issues.”

House Bill 1412 was introduced to create “a pathway for utilities to develop pilot projects that will deliver highly advanced levels of reliability,” though it faced opposition from competitive suppliers. Pennsylvania offers several programs that can support microgrid development, including Property Assessed Clean Energy (PACE) financing, the Solar Energy Program (SEP), and the Alternative and Clean Energy (ACE) Program.

Nevada

Nevada has established several policies affecting microgrid development:

- Renewable Portfolio Standard (RPS): Establishes the required annual percentage of electricity that Nevada utility providers must obtain from renewable energy sources

- Interconnection Standards: Allow for various distributed generation technologies, with a maximum system size of 300kW for non-residential applications

- Net Metering and Energy Export Rights: Allowing customers with solar systems to offset their monthly power bills and export excess energy back to the grid

- Renewable Energy Bill of Rights: Declares that each resident has the right to “generate, consume and export renewable energy and reduce his or her use of electricity that is obtained from the grid”

These policies create a supportive environment for microgrids but lack specific microgrid regulations or frameworks.

New Mexico

New Mexico’s energy landscape is significantly shaped by the Energy Transition Act of 2019, which established ambitious renewable energy goals for the state. This landmark legislation established a statewide renewable energy standard of 50% by 2030 and a goal of 80% by 2040.

The state established the Grid Modernization Grant Program under the Electric Grid Modernization Roadmap Act of 2020 to fund electric grid modernization research and development as the state transitions to 100% zero-carbon electricity. While not directly focused on microgrids, these programs create a supportive environment for their development.

Virginia

Virginia has been classified as having limited microgrid-specific policy, despite significant investment in grid modernization. Key elements of the regulatory framework include:

- Virginia Clean Economy Act (VCEA): Enacted in 2020, mandates 100% renewable electricity by 2045 for Dominion Energy and 2050 for Appalachian Power

- Virginia Grid Reliability Improvement Program (VGRIP): Administered by Virginia Energy to enhance grid resilience

- Energy Storage Requirements: VCEA requires Virginia’s largest utilities to construct or acquire significant energy storage capacity

While these policies support grid modernization and resilience, they lack specific frameworks or regulations for microgrid development comparable to Tier 1 states.

North Carolina

North Carolina has established several policies that affect microgrid development:

- Clean Energy and Energy Efficiency Portfolio Standard (CEPS): Requires investor-owned utilities to meet up to 12.5% of energy needs through clean energy resources or efficiency measures

- House Bill 589 (Competitive Energy Solutions for NC): Expanded customer access to renewable energy through various programs and established a study of energy storage

- Carbon Reduction Targets: The NC Utilities Commission is charged with drafting a plan to achieve 70% emissions reductions by 2030 and net zero by 2050

While these policies create favorable conditions for distributed energy resources, North Carolina lacks specific microgrid regulations or frameworks comparable to leading states.

Incentive Programs & Funding Mechanisms

Federal Programs

Investment Tax Credits

The Federal Investment Tax Credit (ITC) provides significant financial incentives for microgrid components:

- 30% tax credit for qualifying solar systems and battery storage (≥3kWh) through 2032

- Extended by the Inflation Reduction Act (IRA)

- Battery storage systems can qualify for this credit, making solar-plus-storage microgrids more financially attractive

Department of Energy Programs

Several Department of Energy programs provide funding for microgrid projects:

- Grid Resilience and Innovation Partnerships (GRIP) Program: $10.5 billion federal program to enhance grid flexibility and improve power system resilience

- Assisting Federal Facilities with Energy Conservation Technologies (AFFECT) program: Funds microgrid projects at federal facilities

- Community Microgrid Assistance Partnership (C-MAP): Provides both technical assistance and funding to support the design and implementation of microgrid projects, particularly in underserved and Indigenous communities

FEMA Programs

FEMA has funded microgrids under two main programs:

- Hazard Mitigation Grant Program (HMGP): Provides funding for projects that reduce the risk to individuals and property from natural hazards

- Building Resilient Infrastructure and Communities (BRIC) program: Supports communities to undertake hazard mitigation projects, including energy resilience

USDA Rural Energy for America Program (REAP)

The Rural Energy for America Program provides grants and loan guarantees to rural businesses and agricultural producers for renewable energy systems, including microgrid components.

State-Specific Programs

Tier 1 States

California

- Microgrid Incentive Program (MIP): $200 million statewide competitive grant program

- Community Microgrid Enablement Program (CMEP): Provides financial and technical support for community microgrids

New York

- NY Prize Competition: $40 million program following a three-stage process from feasibility to implementation

- Energy Storage Incentive Program: $150 million for bulk storage projects over 5 MW and $130 million for customer-sited retail storage projects below 5 MW

- NY-Sun Initiative: $1 billion program offering financial incentives for solar installation across residential, commercial, and industrial sectors

Massachusetts

- Community Microgrids program: Supported the design of community microgrids throughout Massachusetts with $1.05 million in funding

- SMART Program (Solar Massachusetts Renewable Target): Compensates solar owners for electricity production with additional incentives for solar installations that include energy storage

- ConnectedSolutions Program: Pays an annual incentive for allowing utility companies to access and use electricity stored in batteries during peak demand periods

Connecticut

- Microgrid Grant and Loan Program: Flagship initiative with several funding rounds:

- Round 1 (Pilot): $18 million to nine projects

- Round 2: Grants to two projects from five submitted proposals

- Round 4: $13.1 million to three projects from nine applications

- Connecticut Green Bank: Offers financing options to support microgrid projects, providing assistance with structuring applications and creating financing plans

New Jersey

- Town Center DER Microgrid Incentive Program: Initially established with a $1 million budget, later expanded to over $2 million for 13 feasibility studies

- Energy Storage Incentive Program (NJ SIP): Creates a framework for energy storage incentives, with both upfront and performance-based financial components

- Energy Resilience Bank (ERB): $200 million fund for energy infrastructure projects that provide cleaner, more reliable sources of electricity

Puerto Rico

- Puerto Rico Energy Resilience Fund (PR-ERF): Incentivizes the installation of approximately 30,000-40,000 residential solar and battery systems for Puerto Rico’s most vulnerable households

- Programa de Comunidades Resilientes: $365 million funding opportunity to install solar and battery storage for community healthcare facilities and common areas within subsidized multi-family housing properties

- Solar Incentive Program: Grants covering 30% or up to $15,000 of renewable energy system installation costs for residents

Texas

- Texas Energy Fund: $10 billion fund with $1.8 billion specifically allocated for microgrids

- Renewable Energy Systems Property Tax Exemption: Property tax exemptions for renewable energy systems

- Local Utility Programs: Such as Oncor and AEP Texas SMART Source offering additional incentives for solar and microgrid adoption

Maine

- Grid Resilience Grant Program: Leverages federal infrastructure funding to support microgrid and grid resilience projects, with $6.6 million in grant awards to six utilities and technology providers

- EPA Climate Pollution Reduction Grants: The Passamaquoddy Tribe at Indian Township was awarded nearly $7.5 million for a distributed microgrid project

- USDA Rural Development Funding: Supports microgrid development on Maine islands, with Isle au Haut receiving $211,000 to help fund a 311-kW solar power array

West Virginia

- Electronic Grid Stabilization and Security Fund: Established in recent legislation

- Economic Opportunity Credit: For qualified companies creating at least 20 new jobs

- Manufacturing Investment Credit: Available for industrial applications

- Strategic R&D Credit: Supports research and development activities

Colorado

- Microgrids for Community Resilience (MCR) Grant Program: Provides funding for both planning and implementation of microgrids, with approximately $17.7 million awarded to 25 planning and construction projects

- Grid Resilience Formula Funding: Leverages federal Bipartisan Infrastructure Law funding to support grid resilience projects, including microgrids

Oregon

- Community Renewable Energy Project Grant Program: For projects qualifying as “community energy resilience projects,” grants may cover up to 100% of project costs, not to exceed $1 million

- Energy Trust of Oregon: Developing new pathways for communities pursuing FEMA grants for resilient renewable energy microgrids and plans to offer custom incentives for critical facilities or community resilience hub projects

Tier 2 States

Illinois

- Clean Energy Investment: Over $580 million per year to help spark renewable energy projects

- Battery Storage Incentives: Expanded Solar Renewable Energy Credit (SREC) program, Smart Inverter Rebate, and added rebate for storage systems

Washington

- Clean Energy Fund (CEF): Administered by the Washington State Department of Commerce, with recent funding rounds including:

- $8.1 million awarded to 14 renewable energy projects in 2024

- $3.9 million in grants for 18 electric grid modernization projects, including nine microgrids

- $37 million invested in 46 clean energy projects across Washington state

Vermont

- Clean Energy Development Fund (CEDF): Provides grants and loans for renewable energy projects, including those that incorporate microgrids

- Standard Offer Program: Guarantees long-term contracts for small-scale renewable energy producers

- Green Mountain Power Resilient Home Program: Offers incentives for residential battery storage systems that can be aggregated into a “virtual power plant”

New Hampshire

- Renewable Energy Fund (REF): Administered by the (NHPUC), provides grants for renewable energy projects that could be incorporated into microgrids

- Commercial & Industrial Solar Rebate Program: Offers rebates of $0.40/watt up to $65,000 or 25% of project costs

- Energy Efficiency Programs: NHSaves offers incentives for energy efficiency measures that can be integrated with microgrid projects

Tier 3 States

Pennsylvania

- Property Assessed Clean Energy (PACE) Financing: Enabled commercial PACE financing with two active programs

- Solar Energy Program (SEP): Provides financial assistance through grants and loans to promote solar energy

- Alternative and Clean Energy (ACE) Program: Offers both grants and loans for Pennsylvania businesses, schools, and governments

Nevada

- Battery Storage Incentives: NV Energy offers incentives for battery storage systems, with rates depending on the electric tariff

- Nevada Clean Energy Fund (NCEF): Preparing to launch commercial clean energy revolving loan programs

- Grid Resilience Funding: Available through the Department of Energy‘s Grid Resilience and Innovation Partnerships (GRIP) Program

Virginia

- Virginia Grid Reliability Improvement Program (VGRIP): Offers up to $11.5 million in funding, with subawards up to $5 million for projects enhancing grid resilience

- Property Tax Exemptions: Counties, cities, and towns can exempt or partially exempt energy-efficient buildings from local property taxes

- Virginia Clean Energy Innovation Bank: Partners on innovative energy projects

North Carolina

- Duke Energy Programs:

- PowerPair Program: Offers incentives for solar-plus-battery systems

- Virtual Power Plant (VPP) Program: Allows battery owners to earn up to $92 per month in energy credits

- Accelerating Clean Energy (ACE) Tariffs: Reduced tariff rate structures for large commercial and industrial customers to incentivize investment in long-duration storage

New Mexico

- Alternative Energy Product Manufacturers Tax Credit: Available for qualified manufacturers of alternative energy products

- Grid Modernization Grants: Available to municipalities, county governments, state agencies, state universities, public schools, post-secondary education institutions, and Indian nations, tribes and pueblos

- Energy Transition Act (ETA) Funding: Supports renewable energy projects, including those with storage systems that increase electrical resiliency

Commercial Opportunities By Market Segment

Critical Infrastructure

Critical infrastructure represents a prime opportunity for microgrid development across all analyzed states, with particular emphasis on:

- Healthcare Facilities: Hospitals and medical centers require uninterrupted power for life-saving equipment and operations. Examples include Citizens Medical Center in Texas implementing microgrids to ensure uninterrupted power during emergencies.

- Emergency Services: Police stations, fire stations, and emergency operations centers benefit from enhanced resilience. In Illinois, Chicago’s Bronzeville Community Microgrid serves the Chicago Public Safety Headquarters.

- Water and Wastewater Treatment: Critical for public health during extended outages. New Jersey’s Town Center DER Microgrid Program identifies these facilities as priorities for microgrid development.

- Government Buildings: Serving as emergency shelters or coordination centers. West Virginia’s recent microgrid legislation emphasizes critical infrastructure protection.

- Educational Facilities: Often serving as community shelters during disasters. In Washington, the Puyallup School District received funding for a solar plus storage microgrid to improve the resilience of a local elementary school.

States particularly focusing on critical infrastructure include New Jersey (following Superstorm Sandy), Puerto Rico (following hurricane impacts), and California (through the Community Microgrid Enablement Program).

Figure 2: Citizens Medical Center

Figure 3: Cluster of solar arrays in Bronzeville Community Microgrid

Figure 4: Northwood Elementary School

Data Centers and Commercial Properties

Data centers represent a rapidly growing market for microgrids due to their critical need for uninterrupted power:

- West Virginia: Recent legislation specifically targets data centers with the Power Generation and Consumption Act establishing a High Impact Data Center Program.

- Virginia: Hosts one of the nation’s largest data center hubs, consuming approximately 22% of Dominion Energy‘s electricity. Microgrids provide resilience and renewable energy integration for these facilities.

- Texas: Data centers are implementing microgrids to ensure reliability during extreme weather events that have strained the state’s grid in recent years.

Commercial real estate also presents significant opportunities:

- Microgrids offer multiple benefits including mitigating power supply risks, increasing asset value, and creating revenue-generation opportunities.

- In Nevada, growing commercial and data center sectors represent significant opportunities.

- Texas has seen rapid growth in commercial microgrids, increasing from 17 in 2016 to over 300 by 2023.

Community Microgrids

Community microgrids serving multiple stakeholders have received particular emphasis across several states:

- New York: The NY Prize Competition specifically targets community microgrids that can enhance resilience for vulnerable populations.

- California: The Community Microgrid Enablement Program (CMEP) provides financial and technical support to help communities develop microgrids.

- Puerto Rico: Community-based microgrids are being developed across rural Puerto Rico. In Adjuntas, the nonprofit Casa Pueblo led a $2 million project to create community-owned solar microgrids serving local businesses.

- Massachusetts: The MassCEC Community Microgrids program supported 13 feasibility studies for projects throughout the state.

- Connecticut: The state specifically identifies “critical facilities” eligible for microgrid development, including hospitals, police stations, and community centers.

Rural and Tribal Communities

Rural and tribal communities represent significant opportunities for microgrid development:

- Maine: Island communities like Isle au Haut, Mount Desert Island, and Matinicus are exploring or implementing microgrids. The Passamaquoddy Tribe and Penobscot Nation have secured significant funding for microgrid projects.

- Washington: The Swinomish Indian Tribal Community received over $1.75 million to integrate microgrids into a new residential community, while the Tulalip Tribes received $2 million to install a microgrid at their Gathering Hall.

- New Mexico: The Community Microgrid Assistance Partnership (C-MAP) assists remote, rural, and electrically isolated communities in developing resilient microgrid systems.

- North Carolina: Community-based microgrids are being developed in rural areas through electric cooperatives, such as Ocracoke Island and Butler Farms

- Colorado: The Microgrids for Community Resilience (MCR) Grant Program specifically targets cooperative electric associations and municipally owned utilities serving rural communities.

Industrial Applications

Industrial facilities present compelling opportunities for microgrid development:

- Texas: The food industry has been particularly active in microgrid adoption. H-E-B, one of the nation’s largest grocery chains, has installed microgrids at 45 stores. Ben E. Keith Company and other food and beverage companies are implementing microgrids to prevent production losses during power outages.

- Puerto Rico: Eaton‘s manufacturing facility in Arecibo implemented a clean energy microgrid project incorporating 5 MW of solar photovoltaic panels, approximately 1.1 MW of battery storage, and existing onsite generators.

- North Carolina: Agricultural applications include Rose Acre Farms microgrid, featuring a 2 MW solar array, 2.5 MW battery storage system, and backup diesel generation.

- Pennsylvania: The Philadelphia Navy Yard features a six-megawatt natural gas-fired peaking plant as part of its microgrid, designed to run during peak demand periods and when energy costs are high.

- West Virginia: The state’s recent legislation targets industrial facilities, particularly in the industrial corridors near the Ohio River Valley.

Figure 5: Rose Acre Farms solar array

Figure 6: Philadelphia Navy Yard

Key Stakeholders & Partnership Opportunities

Utilities

Utilities play a critical role in microgrid development, with varying levels of engagement across states:

- Investor-Owned Utilities (IOUs): Major players like Pacific Gas & Electric (PG&E), Southern California Edison (SCE), and San Diego Gas & Electric (SDG&E) in California; Dominion Energy and Appalachian Power in Virginia; Duke Energy in North Carolina; and ComEd in Illinois. These utilities administer major microgrid programs and may own microgrids directly.

- Electric Cooperatives: Particularly active in North Carolina, Colorado, and rural areas of several states. North Carolina’s electric cooperatives have implemented multiple microgrids across the state, including the Ocracoke Island Microgrid and Butler Farms Microgrid.

- Municipal Utilities: Often serve as hosts or partners for community microgrids. Seattle City Light in Washington received $500,000 for a microgrid using second-use batteries from transit vehicles.

Partnership strategies with utilities vary by state due to different regulatory frameworks. Maine’s microgrid law allows operators to sell electricity as competitive electricity providers when grid-connected, while Massachusetts’ utility franchise rights give utilities the right of first refusal regarding ownership and operation of infrastructure within “public ways.”

Government Entities

Key government stakeholders include:

- State Energy Offices: Administer funding programs and provide technical assistance, such as the Massachusetts Clean Energy Center, Colorado Energy Office, and Maine Governor’s Energy Office.

- Public Utility Commissions: Regulate utility activities and may have authority over microgrid approval, as with the Maine PUC and California CPUC.

- Economic Development Agencies: Partner on projects with economic benefits, like the West Virginia Department of Commerce and Puerto Rico Industrial Development Company.

- Departments of Environmental Quality: Oversee environmental permitting and compliance, particularly important for microgrids with generation components.

- Emergency Management Agencies: Partners in resilience planning and critical infrastructure protection.

Research Institutions

Research institutions provide technical expertise and demonstration platforms:

- Universities: The Illinois Institute of Technology’s campus microgrid “has saved the university about a million dollars annually” and will connect to ComEd’s Bronzeville Community Microgrid to create one of the nation’s first utility-operated microgrid clusters.

- National Laboratories: Provide technical assistance for microgrid projects, such as Oak Ridge National Laboratory working with Puerto Rico on technologies like “microgrid orchestrators.”

- Research Centers: The NC Clean Energy Technology Center based at North Carolina State University and the Schatz Energy Research Center at Cal Poly Humboldt partner on microgrid projects.

Private Sector

Private sector stakeholders include:

- Solar Developers: Companies like Sunrun, Hawaii Pacific Solar, and RevoluSun integrate solar components into microgrids.

- Engineering Firms: Provide technical expertise for design and implementation, with companies like Schneider Electric and Eaton being particularly active.

- Energy Storage Providers: Supply critical components for microgrid functionality and resilience.

- Microgrid Developers: Specialized companies like Enchanted Rock and PowerSecure have commissioned numerous projects in Texas and other states.

Challenges & Barriers

Regulatory Complexity

Regulatory challenges vary significantly across states but common themes include:

Unclear Definitions and Authority: Pennsylvania lacks explicit laws defining microgrids, creating uncertainty around their classification as either generation (competitive arena) or distribution (utility jurisdiction).

Interconnection Barriers: The process for connecting microgrids to the main grid is often “prohibitively cumbersome, expensive, and opaque” according to Pennsylvania stakeholders.

Public Way Restrictions: Massachusetts utility franchise law gives utilities the right of first refusal regarding ownership and operation of infrastructure within “public ways” (streets), making community microgrid projects necessarily collaborative efforts.

Compensation Mechanisms: Ongoing debates about how microgrids should be compensated for electricity sold to the grid, with options including net metering, feed-in tariffs, and dynamic electricity pricing.

Financing Challenges

Despite the availability of incentives, financing remains a significant barrier:

- High Upfront Costs: Capital expenditures for microgrids can be substantial, particularly for systems with significant storage capacity.

- Value Stream Recognition: According to Steve Fine of ICF, “Getting incentives right means taking into account and quantifying the range of values that microgrids can bring to the grid, as well as helping customers to understand the added benefits.”

- Long Payback Periods: Jim Freihaut of Penn State University notes that the payback period of 4-6 years for microgrids is “a little bit too long for most people,” suggesting government incentives are necessary.

- Funding Gaps: While grant programs exist in many states, they often require matching funds and may not cover ongoing maintenance and operations.

Technical Integration

Technical challenges include:

- Grid Integration: Complex requirements for interconnection and protection, particularly for systems capable of islanding.

- Controller Technology: Sophisticated control systems are needed to manage transitions between grid-connected and island modes. Duke Energy’s Hot Springs microgrid development process took four years partly due to these technical challenges.

- Standardization Issues: Lack of standardized designs and specifications increases engineering costs and complexity.

- Skilled Workforce: Limited availability of qualified personnel with microgrid design, implementation, and operation experience.

Utility Relations

Relationships with existing utilities create both challenges and opportunities:

- Business Model Concerns: Traditional utility business models may view microgrids as competition or revenue threats.

- Franchise Rights: Utilities’ exclusive rights to provide service in certain territories can conflict with microgrid development.

- Rate Impacts: In West Virginia, concerns have been raised about costs being shifted to non-microgrid customers if large users defect from the grid.

- Operational Integration: Technical challenges in coordinating microgrid operations with the broader utility system.

Regional Market Analysis

Northeast

The Northeast region features some of the most progressive microgrid policies and initiatives in the country:

- Massachusetts, Connecticut, New York, New Jersey, and Maine are classified as Tier 1 states for microgrid policy activity.

- The region was heavily impacted by Superstorm Sandy and other extreme weather events, driving significant investment in resilience through microgrids.

- Key programs include New York’s NY Prize Competition, Connecticut’s Microgrid Grant and Loan Program, Massachusetts’ Community Microgrids Program, and New Jersey’s Town Center DER Microgrid Program.

- Notable projects include the Philadelphia Navy Yard microgrid in Pennsylvania and multiple awarded projects in New Jersey including the Atlantic City microgrid (awarded $1,125,000 in Phase II).

Southeast

The Southeast presents a mixed landscape for microgrid development:

- North Carolina leads the region with significant microgrid projects developed by Duke Energy and electric cooperatives, including the Hot Springs microgrid and Butler Farms Microgrid.

- Virginia is classified as a Tier 2 state with policies like the Virginia Clean Economy Act and Virginia Grid Reliability Improvement Program supporting microgrid development.

- Florida (not covered in detail in this report) has opportunities driven by hurricane resilience needs.

- Military installations represent significant opportunities throughout the region, as demonstrated by the Fort Belvoir Microgrid in Virginia.

Midwest

The Midwest shows varying levels of microgrid policy development:

- Illinois is at the forefront with ComEd’s Bronzeville Community Microgrid serving as a flagship project. This project serves more than 1,000 customers including the Chicago Public Safety Headquarters and will eventually connect to the Illinois Institute of Technology’s microgrid.

- Wisconsin, Michigan, and Ohio (not covered in detail) offer opportunities particularly for industrial applications and critical infrastructure.

- The region’s severe weather events, including winter storms and tornadoes, create compelling resilience value propositions for microgrids.

Southwest

The Southwest region shows significant activity, particularly in Texas:

- Texas has experienced explosive growth in microgrid deployment, with commercial microgrids increasing from just 17 in 2016 to over 300 by 2023. Since Winter Storm Uri in early 2021, commercial customers have added nearly 100 defined microgrids statewide.

- New Mexico is considered a Tier 3 state with programs like the Grid Modernization Grant Program established under the Electric Grid Modernization Roadmap Act of 2020.

- Arizona (not covered in detail) presents opportunities particularly for remote communities and military installations.

West Coast

The West Coast includes some of the most progressive states for microgrid policy:

- California leads with comprehensive programs including the Microgrid Incentive Program (MIP) and Community Microgrid Enablement Program (CMEP).

- Washington has demonstrated strong support through the Clean Energy Fund (CEF) and Grid Modernization Program, with recent funding rounds supporting numerous microgrid projects.

- Oregon has several policies supporting microgrid development, including the Community Renewable Energy Project Grant Program established by House Bill 2021.

Climate-driven grid disruptions, including wildfires, have created urgent need for resilience solutions in these states.

Non-Contiguous States and Territories

Hawaii and Puerto Rico present unique opportunities and challenges:

- Hawaii has pioneered microgrid policies through the Microgrid Services Tariff (MST) and has the highest electricity rates in the nation (over 30 cents per kilowatt-hour), creating favorable economics for microgrid projects.

- Puerto Rico has established a comprehensive legal framework for microgrids, defining three types (personal, cooperative, and third-party) and implementing interconnection requirements through the Energy Public Policy Act.

- Both face natural disaster risks that drive resilience needs, with Puerto Rico’s market expected to more than double by the end of 2024, reaching 228 MW of capacity.

Strategic Recommendations

Target Market Prioritization

Based on the corrected tier classifications and comprehensive analysis, priority markets include:

- Tier 1 States with Established Programs: California, Hawaii, New Jersey, New York, Connecticut, Massachusetts, Texas, Puerto Rico, Maine, West Virginia, and Colorado all have comprehensive microgrid-specific regulations and funding programs. These markets offer the clearest regulatory pathways and most substantial financial support.

- Critical Infrastructure Facilities: Focus on facilities with essential resilience needs and available funding, including hospitals, emergency services, water/wastewater treatment, and military installations. States with specific programs targeting critical infrastructure include New Jersey, California, and Colorado.

- Data Centers and High-Tech Industry: Target the growing data center market, particularly in Virginia and West Virginia. West Virginia’s recent legislation specifically establishes a High Impact Data Center Program to support microgrid development.

- Disadvantaged and Vulnerable Communities: Many state programs prioritize environmental justice communities, tribal lands, and areas with historical grid reliability issues. California’s MIP, Washington’s tribal community projects, and Maine’s rural/island initiatives exemplify this focus.

- Industrial and Commercial Facilities: Energy-intensive industries benefit from the resilience and potential cost savings of microgrids. Texas has seen significant adoption in the food industry, while Puerto Rico has implemented projects at manufacturing facilities.

Partnership Strategies

Successful market entry requires strategic partnerships:

- Utility Collaboration: Early engagement with local utilities is essential for addressing interconnection requirements and potential tariff issues. In states like Massachusetts where utilities have franchise rights over public ways, direct utility partnerships may be necessary.

- Government Relationships: Develop relationships with state energy offices, public utility commissions, and local governments that may provide funding or facilitate regulatory approvals. Colorado counties receive $50,000 each for energy resilience planning, creating immediate partnership opportunities.

- Technical Partnerships: Collaborate with engineering firms, solar developers, and technology providers who understand local markets and regulatory environments. Regional expertise is particularly valuable in navigating varying interconnection standards.

- Community Engagement: When developing community microgrids, engage with local stakeholders early in the process. Puerto Rico’s successful microgrids have involved significant community participation.

- Research Institution Alliances: Partner with universities and research institutions that may serve as demonstration sites and provide technical expertise. Illinois Institute of Technology and Eastern Mennonite University (Virginia) have implemented successful campus microgrids.

Value Proposition Development

Effective value propositions should emphasize:

- Resilience Benefits: The primary driver for microgrid adoption in most markets is enhanced resilience against grid outages due to extreme weather events, cyber threats, or infrastructure failures.

- Economic Advantages: Highlight potential cost savings from reduced energy usage, avoided outage costs, and participation in grid services markets. Texas microgrids can generate revenue through ERCOT’s demand response programs.

- Sustainability Goals: Align with state and corporate clean energy targets. California, New York, and Massachusetts have ambitious renewable energy goals that microgrids can help achieve.

- Regulatory Compliance: Position microgrids as solutions for meeting renewable portfolio standards and emissions reduction targets.

- Multi-Benefit Approach: Stack multiple value streams, including resilience, economic benefits, and sustainability. Massachusetts projects can capture revenue from SMART program incentives, ConnectedSolutions payments, and resilience value.

Geographic Focus

Based on this comprehensive analysis, these geographic areas present the strongest opportunities:

- Tier 1 States with Recent Legislation: West Virginia and Colorado have recently enacted comprehensive microgrid legislation, creating immediate opportunities as these programs are implemented.

- Hurricane-Prone Regions: Coastal areas in the Northeast, Southeast, and Gulf Coast have experienced significant power outages from hurricanes, creating urgent resilience needs. New Jersey, Puerto Rico, and the Florida coast (not detailed in this report) are prime examples.

- Wildfire-Vulnerable Territories: Western states, particularly California and parts of Oregon and Washington, face increasing wildfire risks that threaten grid infrastructure.

- Remote and Island Communities: Rural areas with less reliable grid connections or higher costs for infrastructure upgrades. Maine’s islands, Puerto Rico, Hawaii, and remote tribal communities present significant opportunities.

- High Electricity Cost Regions: Areas with electricity rates significantly above the national average, such as Hawaii (>30¢/kWh), making the economic case for microgrids more compelling.

- Industrial Corridors: Regions with concentrations of energy-intensive industries, such as Texas’s Houston area, West Virginia’s Ohio River Valley, and Pennsylvania’s industrial hubs.

- Tribal Communities: Washington, Colorado, and Maine have all provided specific funding for tribal microgrid projects, recognizing the unique energy challenges and sovereignty considerations of these communities.

Conclusion

The US microgrid market presents significant opportunities driven by resilience needs, clean energy goals, and technological advancements. The regulatory and incentive landscape varies substantially across states, with eleven states now classified as having comprehensive microgrid-specific regulation: California, Hawaii, New Jersey, New York, Connecticut, Massachusetts, Texas, Puerto Rico, Maine, West Virginia, and Colorado.

The corrected tier classifications reveal a more complex and rapidly evolving landscape than previously understood, with states like West Virginia making significant legislative advances to join the ranks of microgrid policy leaders. These developments create new geographic priorities for market entry, with recently enacted legislation in states like West Virginia and Colorado creating immediate opportunities as these programs are implemented.

Commercial opportunities exist across multiple sectors, with critical infrastructure, data centers, remote communities, and industrial applications showing the strongest potential. The most successful microgrid projects leverage multiple value streams and align with broader policy goals related to resilience, sustainability, and economic development.

Key success factors for market entry include:

- Understanding state-specific regulatory frameworks and incentive structures, with particular focus on Tier 1 states with comprehensive microgrid-specific regulation

- Developing strategic partnerships with utilities, government entities, and technical experts

- Creating clear value propositions that highlight resilience benefits alongside economic advantages

- Targeting geographic areas with demonstrated grid vulnerabilities or high electricity costs

- Leveraging available funding mechanisms from federal, state, and utility programs

The microgrid market is expected to continue its rapid growth as extreme weather events increase, clean energy goals advance, and technology costs decline. Companies that can navigate the complex regulatory landscape while delivering compelling value propositions will be well-positioned to capture this growing market opportunity.